What is Natural Capital?

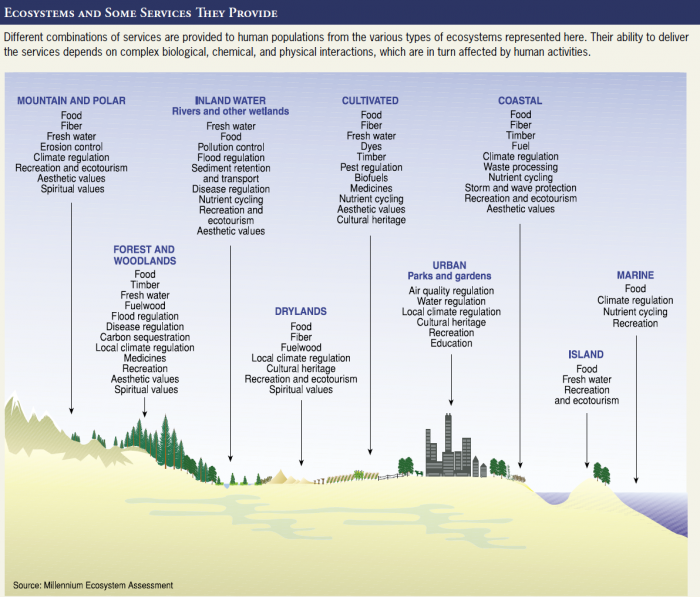

Natural capital is defined as the earth’s stock of natural assets. Those assets are part of the world’s ecosystems, “a geographically specified system of organisms (including humans), and the environment and the processes that control its dynamics” according to the Millennium Ecosystem Assessment. Ecosystem services are the flow of benefits provided by these systems and generally fall into four categories:

- Provisioning services – products obtained from ecosystems including food, water, wood and fiber air, carbon based fuels, minerals and chemicals.

- Regulating services –benefits obtained from the regulation of ecosystem processes including climate regulation, flood regulation, water purification, disease regulation, and pollination.

- Cultural services – nonmaterial benefits obtained from ecosystems including recreational, aesthetic, educational, cultural heritage, and spiritual benefits.

- Supporting services – services necessary for the production of all other ecosystem services including nutrient cycling, soil formation, and photosynthesis.

For an in-depth overview of ecosystem services, see Corporate Ecoforum Valuing Natural Capital Initiative, The Economics of Ecosystems and Biodiversity, and Corporate Ecosystem Valuation.

One of these benefits is the production of ecosystem goods, the physical benefits from the working of an ecosystem, like food, timber, and water. In addition, ecosystem services provide benefits through life-sustaining functions such as water regulation and nutrient recycling as well as through the aesthetic/cultural benefits that are afforded by an ecosystem. See the graphic below for a fuller understanding of the scope of ecosystems and the associated benefits they provide. (There are many classification systems and each has their strengths and weaknesses and specifically speaks to different applications. The U.S. Environmental Protection Agency, or EPA, recently introduced a comprehensive and standardized classification system for ecosystem goods and services—the Final Ecosystem Goods and Services, to be used by people, communities, and businesses to measure, map, model and value ecosystem services. Other classification systems include The Economics of Ecosystems and Biodiversity, the Millennium Ecosystem Assessment, and the Common International Classification of Ecosystem Services or CICES. CICES created a tool to navigate between some of these classifications.)

Natural capital stocks and ecosystems services are distinct from, though related to, the concept of sustainability. Sustainability means meeting the needs of current populations while also preserving the ability to provide for future generations. In the business context, sustainability is often associated with efficient production, gained through improvements such as more efficient use of energy or water, and waste reduction. Resilience, another related concept, has garnered a lot of attention recently as well, from both the business and environmental communities. Resilience includes the ability to prepare for, withstand, and bounce back after an adverse effect, like a hurricane or super storm. Careful management of natural capital and the ecosystem services that flow from this capital is crucial to ensuring that sustainability and resilience can be achieved. For example, careful management of green infrastructure -such as mangrove forests which have a role in coastal protection by serving as a natural barriers from waves and storm surge – help to ensure resilience of coastal businesses. For information on the importance of green infrastructure to business resilience, see NOAA’s and EPA’s green infrastructure sites.

Natural Capital and Market Failures

The terms stock and flow are commonplace in economics, but what is perhaps new is the application of these terms to nature and the idea that nature and the ecosystem services it provides are inputs used by businesses. Standard cost functions for businesses would typically include the amount of labor used to produce given levels of output, the price paid for that labor, along with levels and prices of various types of capital, such as machinery, equipment or buildings that are used in production. Natural capital is an input to production just like these other forms of capital, and, as with machinery or buildings, it is important to factor the cost of natural capital into the decision making of a firm. Incorporating natural capital into decision-making can alter the types of investments that a company makes and the profitability of certain investments.

However, the incentives for firms to consider natural capital generally and integrate it into the operations and planning can be distorted. Given that many types of natural capital are not traded in a market, it is difficult for businesses to have accurate information on prices. In the past, to the extent businesses included natural capital in their business planning, they may have assumed the price for natural capital was zero. With most natural resources being available in abundance (i.e. supply greatly exceeded demand), the price for these resources would be viewed as zero. Many firms are rapidly realizing that this is not the case and are looking to shift their practices.

Business incentives related to natural capital are also distorted because businesses do not necessarily take into account the ways in which their use of natural capital can affect the rest of the economy. For example, the use of natural capital can create “externalities,” which result when the use of certain resources has costs or benefits to society that are greater than those for the individual who is using the resource. This can result in a market failure; there may be overuse or underinvestment in the resource since the societal costs and benefits are not taken into account by private decision-makers. For example, if a manufacturing firm creates air pollution, this imposes societal (health and cleanup) costs. If the firm does not account for those costs, it will overproduce and over-pollute compared to the case when costs, including societal costs, are fully taken into account.

To further complicate this issue, natural capital can often be considered a “public good.” Public goods are goods (or services) that are non-rival (the consumption of a good or service by one person doesn’t prevent others from consuming the same good or service) and non-excludable (it is not possible to prevent someone from using the good or service.)[2] Pure public goods are not likely to be provided in efficient amounts by private markets; for example, if consumers or businesses cannot be excluded from using a good or service it can be difficult to get them to pay for it. This would result in the under provision of this public good by the private sector. In the context of natural capital, the ozone layer is an example of a resource that has the characteristics of a pure public good.

However, some types of natural capital may be non-excludable but there may be rivalry in their consumption: fisheries are a good example of this type of good or service. Goods and services that are non-excludable but that have rivalry in consumption are subject to the “tragedy of the commons.” That is, without some type of regulation on usage, consumers or businesses will be inclined to overuse the resource and deplete it more quickly than is optimal. Learn about NOAA’s efforts to combat illegal, unreported, and unregulated fishing here.

Today, individuals and firms are starting to realize that natural capital can be depleted, so the zero price assumption no longer holds. As will be discussed below, natural capital can have private benefits, and firms can incorporate its costs into decision making just like other capital. Taking natural capital into account doesn’t necessarily translate into a reduction in profits but can also be beneficial to businesses. One example is Dow Chemical Company’s first natural-capital related project, a collaboration with The Nature Conservancy. The project comprised an engineered natural treatment system for industrial wastewater -- essentially a constructed wetland, built at one of their Texas facilities in 1995. This project now has a net present value of cost savings of $280M. See the Case Studies section for more details about this Dow investment and additional examples of the benefits firms have realized by taking natural capital into account in their decision-making.